Apply Now

Home

Apply Now

Home

Apply Now

For any small or medium scale business,

the reliance on receivables from top

quality clients is the grease helping the

business flourish. We have often seen

cases with SMEs, where enlisting with a

large corporate client not only helps

secure their receivables, but also allows

to have better terms with suppliers.

However, large clients usually come with

pressures on delivery, quality and most

importantly efficient timelines. Hence our

solutions to SMEs with strong customers

local or international is to reach out to us

and discuss mechanisms to help secure

liquidity and get paid early on these

invoices.

With our receivables financing product, we

can help SMEs get paid early on regular

invoices raised on large customers. These

invoices can be financed up to a

maximum period of 90 days and we

believe this can be sufficient to run the

business more efficiently.

Invoice Bazaar can help you procure by

offering a vendor finance line. This

facility is provided against your inventory

being kept as a collateral with our

partner logistics company. We have

partner logistics and freight forwarding

companies within Jebel Ali Free Zone as

well as in Dubai Mainland. The tripartite

documentation helps you to get liquidity

against your stock thereby helping you

with your working capital. The facility can

be used for making payment to your

suppliers.

Invoice Bazaar is open to FMCG, Food

Commodity and other long expiry

commodities as underlying goods for

providing Inventory Finance facility. The

Product works well for Trading

companies, Manufacturers and

Retailers. Typical Inventory Finance

structures are for 60 to 90 days. Please

apply on the above form selecting

“Inventory Finance” in the dropdown

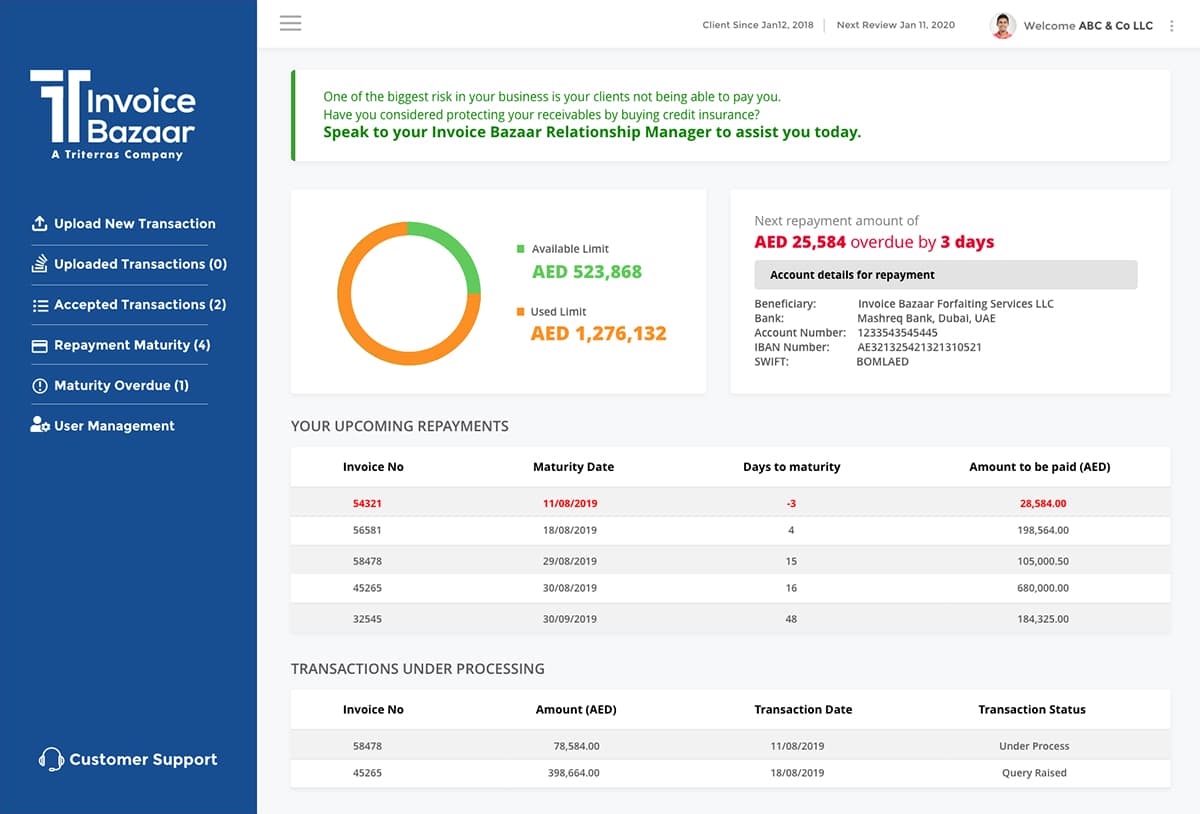

Our online dashboard helps our clients check on credit limits available, current utilization and due dates on payments to be received, making it easy for them to track transactions. Our credit evaluation process is quick and we can ascertain credit limits on each of the buyers. We can liquidate the loan booked against invoices by receiving payments directly from your customers.